are 529 contributions tax deductible in oregon

All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit. Until 2020 contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits.

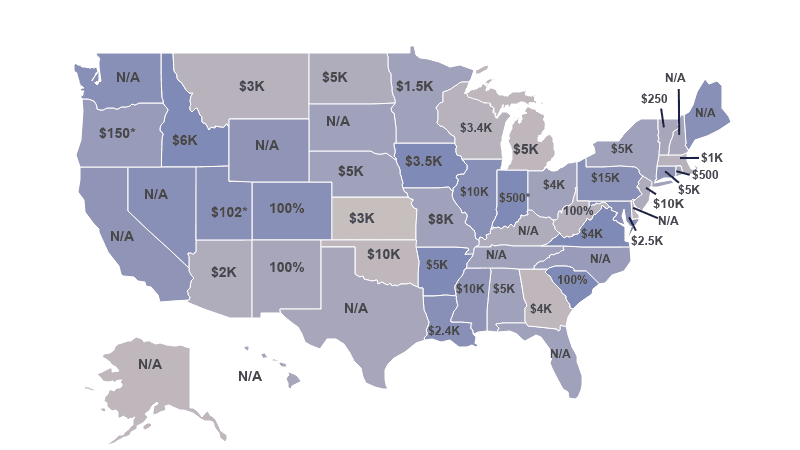

529 Plans Which States Reward College Savers Adviser Investments

People who put money into a 529 account can deduct that contribution from their taxable state income up to 4660 in 2017 for married.

. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for. Credit recaptures for Oregon 529 College Savings Network and ABLE account contributions. 4 rows Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan.

However there are maximum aggregate limits which vary by plan. Create an Oregon College Savings Plan. Good news for Oregon residents by investing in your states 529 plan.

If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a. Tax-Advantaged College Savings Plan With Low Fees From American Funds. Although contributions arent tax-deductible the.

Starting January 1 2020 Oregon will be the first state in the nation to offer a refundable tax credit for contributions made to its 529 College Savings Plan. Its up to you to keep records showing the contribution in the event of an audit. But 34 states do offer some form of.

And Oregonians can still take advantage of this perk based on the contributions they made before December 31 2019. That means they dont qualify for a tax deduction on your federal income taxes. Contributions and rollover contributions up to 2435 for a single return and up to 4865 for a joint return are deductible in computing Oregon taxable.

If you claimed a tax credit. Ad Among Americas Best Plans. In the past contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits.

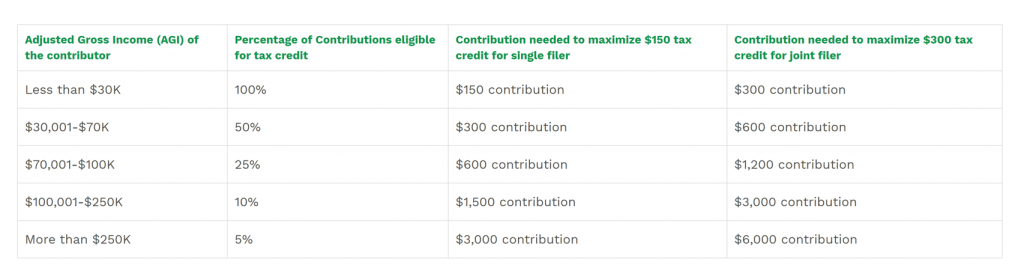

Income over 250k is 5 x 6000 300. For Oregon 529 contribution there is a tax credit of 300 available but turbo tax is only allowing me a credit of 86. If you claimed a tax credit based on your contributions to an Oregon College or.

Ad Among Americas Best Plans. Oregon has an additional incentive. Oregon is one of the few states that offers a tax credit for contributions - you.

When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit carryforwards below The tax credit. There is also an Oregon income tax benefit. Full amount of contribution.

Earnings from 529 plans are not subject to federal tax and generally not subject to state tax when used for qualified education expenses such as tuition fees books as well as. And Oregon residents with out-of-state family members contributing to your childs 529 can take a. Deposit your Oregon personal income tax return refund into a preexisting Oregon College Savings Plan or MFS 529 Savings Plan account.

529 plans typically increase the contribution limit over time so you may be able to contribute more. For example in 2019 individual taxpayers were. Until 2020 contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits.

Tax-Advantaged College Savings Plan With Low Fees From American Funds. Here are the special tax benefits and considerations for using a 529 plan in Oregon. 529 plan contributions arent typically tax-deductible but they are exempt from federal and state taxes when used for qualified higher education expenses tuition room and.

Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct. In 2019 individual taxpayers were allowed to. Previously Oregon allowed tax-deductible contributions.

Unlike IRAs or 401ks there are no annual contribution limits for 529 plans. 529 plan contributions are made with after-tax dollars. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes.

You do not need to. Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings plans.

Where Do I Enter Contributions To A 529 Plan For T

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

529 Tax Deductions By State 2022 Rules On Tax Benefits

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

529 Plans Which States Reward College Savers Adviser Investments

Can You Use Your 529 Plan For More Than College Trade School 529 Plan Student Loan Interest

Oregon 529 Contribution I Thought Oregon Gave A Tax Break For 529 Contributions But My Turbotax Premier Version Does Not Give Me A Place To Enter It

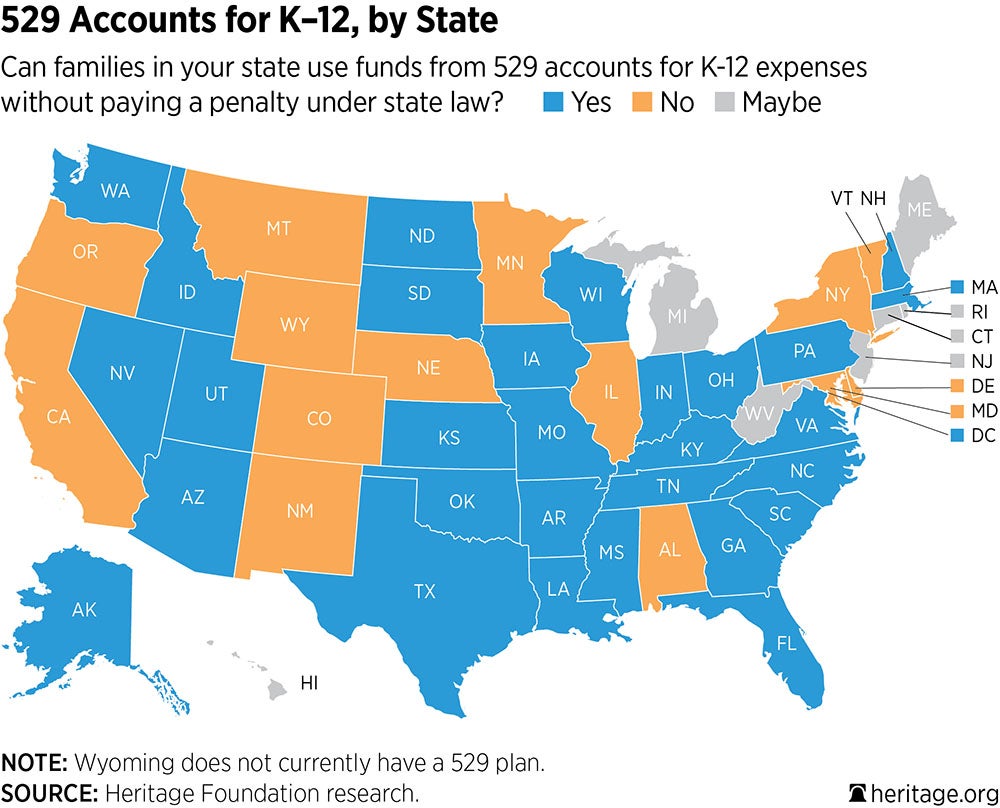

529 Accounts In The States The Heritage Foundation

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans State Tax 529 College Savings Plan

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

529 Plans Which States Reward College Savers Adviser Investments